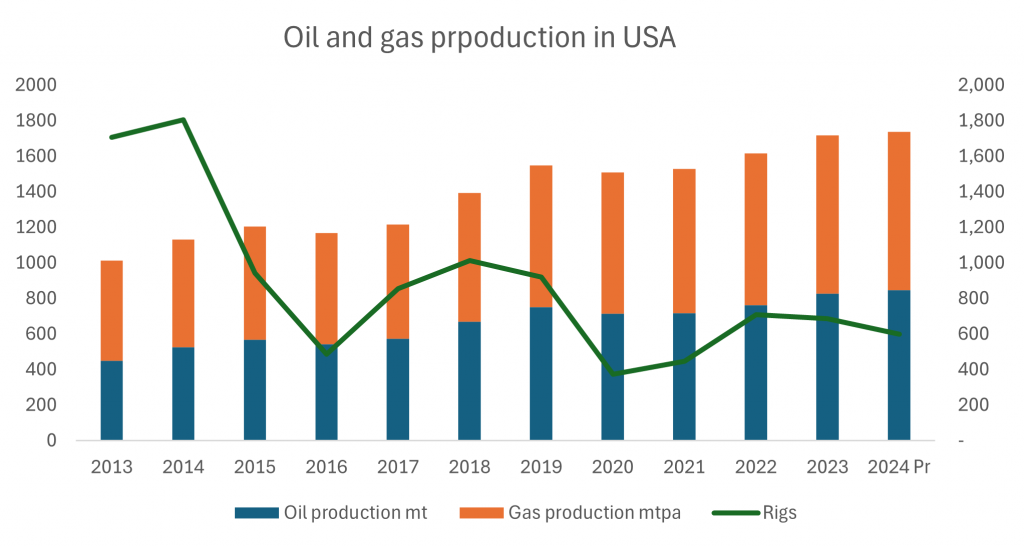

The United States accounted for 18% of global crude oil and condensate production in 2023 and 26% of global marketable gas. The country’s share continued to grow in 2024.

The U.S. relies heavily on the Permian Basin, Eagle Ford, and Bakken for oil production and the Appalachian Basin (Marcellus and Utica) and Haynesville for natural gas. Major customers include domestic refiners, LNG buyers in Europe and Asia, pipeline exports to Mexico, and unconventional producers seeking feedstock. Sustaining production requires high oil prices, with support from OPEC’s market strategies to keep them elevated.

Oilfield services (OFS) activity remained moderately low, with comparatively sluggish demand for fracking, horizontal drilling, and well completion services, despite technological leadership in unconventional plays. The largest clients include ExxonMobil and Chevron, both expanding through aggressive consolidation, acquiring key shale assets and smaller producers. Other major players include ConocoPhillips, EOG Resources, XTO Energy, and Hess.

Multinational companies maintain a strong presence in offshore Gulf of Mexico developments, though activity has been somewhat subdued by the greater flexibility and shorter investment cycles of shale.

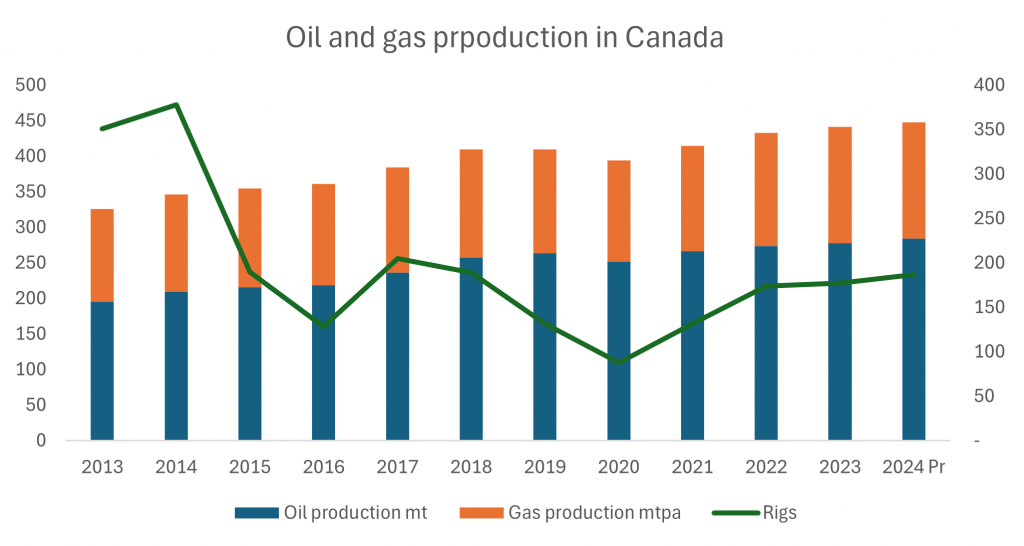

Canada accounted for 6% of global crude oil and condensate production in 2023 and 5% of global marketable gas. The country’s share remained stable in 2024.

Canada relies heavily on the oil sands (Athabasca, Cold Lake, and Peace River), the Montney and Duvernay formations, and offshore Atlantic projects for production. Major customers include U.S. refiners, LNG buyers in Asia, and domestic markets. While the country has substantial upside in oil and gas production, growth depends on prices, pipeline expansions, environmental policies, and investor confidence.

Oilfield services (OFS) activity remained steady, supported by oil sands operations and unconventional drilling in Western Canada. The largest clients include Suncor, Canadian Natural Resources (CNRL), and Cenovus, with key offshore developments in Newfoundland and Labrador.

USA and Canada Upstream and Oilfield Services Report 2022

50% discount

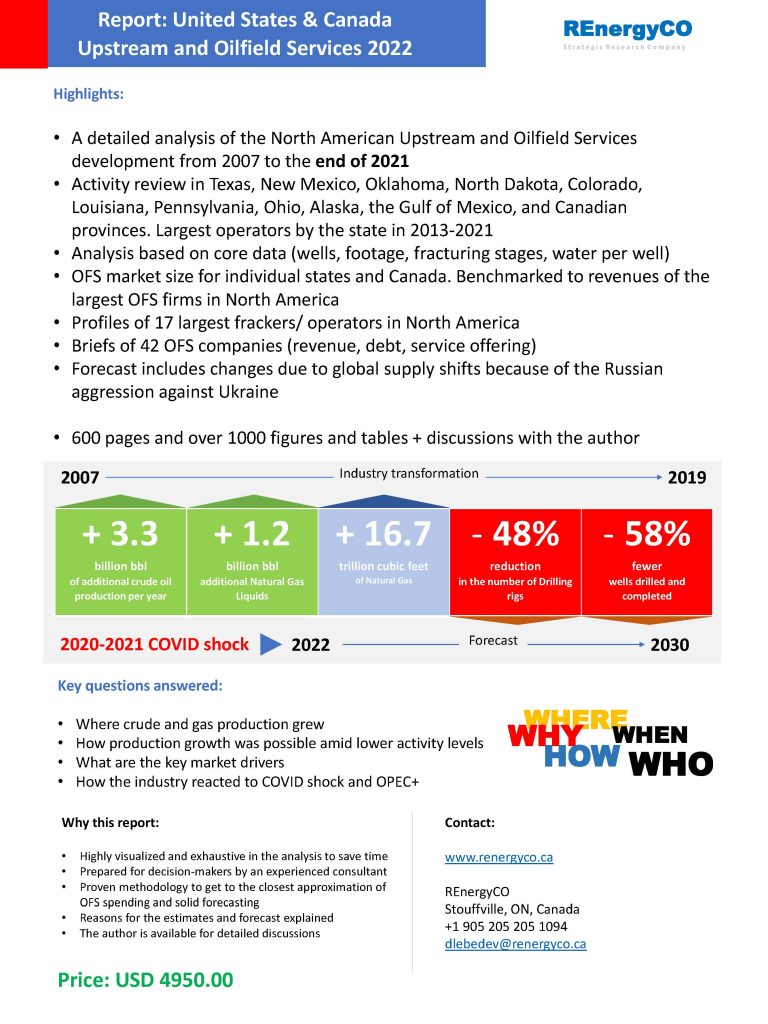

REnergyCO is pleased to announce the release of the second edition of the USA and Canada Upstream and Oilfield Services Report. The report’s content and list of figures and tables are in a downloadable PDF file below.

REnergyCO has a unique perspective for assessing the oil and gas upstream and oilfield services market. We are confident that industry professionals will find the report useful. We base our confidence on the results of the laborious study of the vast amounts of data. Careful benchmarking and crosschecking of the data offer high granularity of the picture.

The report presents in numbers the amazing story of the industry development in the past 14 years. The story transformed the world and will continue reshaping the global energy industry in the future. The report includes an oil and gas production and oilfield service industry forecast for 2022-2030.