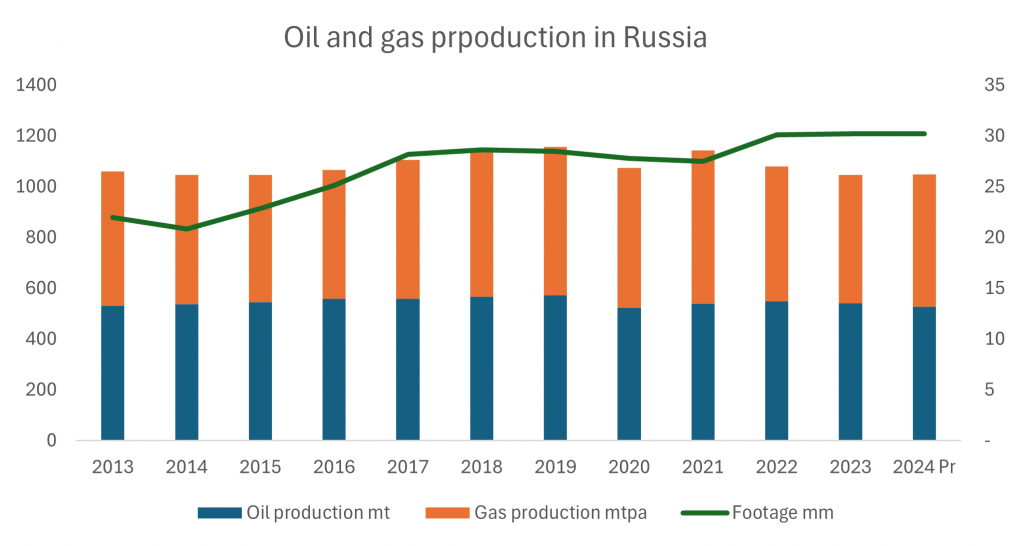

Russia accounted for 12% of global crude oil and condensate production in 2023 and 14% of global marketable gas. The country’s share changed little in 2024.

Russia relies heavily on Western Siberia, Eastern Siberia, and Arctic projects for production and on export pipelines and seaborne routes for transporting oil and gas to global markets. Major customers include China (CNPC), and India via alternative routes. While the country has a substantial upside in oil and gas production, realizing this potential is unlikely without resolving sanctions-related restrictions and logistical challenges.

Oilfield services (OFS) activity remained high despite sanctions, supported by domestic service providers, counterfeit equipment, and weakly enforced trade restrictions. The largest clients include Rosneft, Gazprom, and LUKOIL, with key offshore developments in the Caspian Sea and Sakhalin.

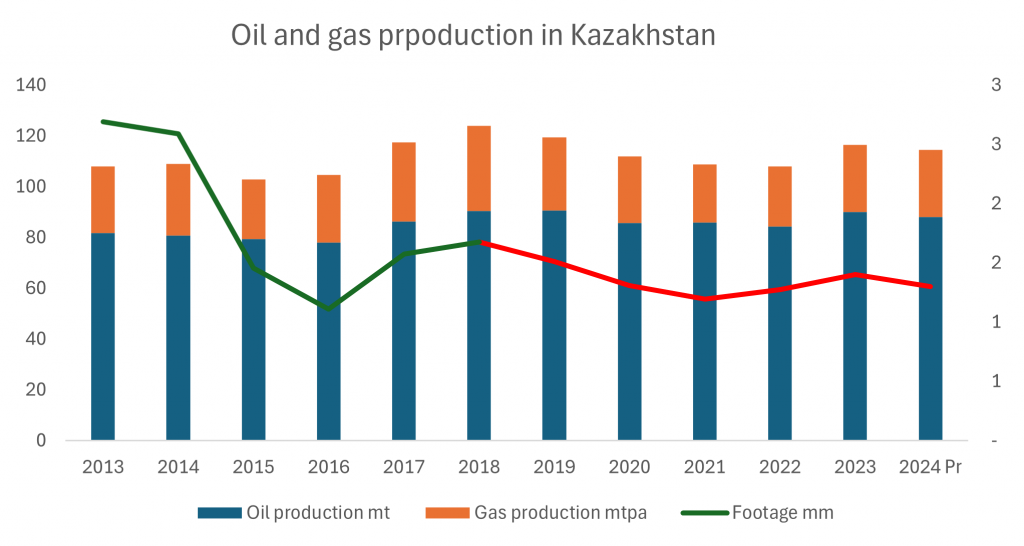

Kazakhstan accounted for 2% of global crude oil and condensate production in 2023 and 0.8% of global marketable gas. The country’s share changed little in 2024.

Kazakhstan relies heavily on three mega projects—Tengiz (TCO), Kashagan (NCOC), and Karachaganak (KPO)—for production and on Russia for transporting oil to global markets. Major customers include KazMunayGas and CNPC. While the country has substantial upside in oil and gas production, realizing this potential is unlikely without resolving transport issues.

Oilfield services activity remained low due to the limited movability of crude and gas. However, the mega projects continue to offer highly expensive drilling and construction contracts.

*Footage estimate for 2019-2024