A consulting and research company specializing in the oil and gas industry and oilfield services. Established in 2008 the company worked with some of the largest companies in the Oil and Gas Industry. The company has broad consulting experience in various aspects of running a company in the Energy Industry. Please refer to the Menu above for descriptions of the company reports.

Services include:

- Published Market Intelligence

- Customized Proprietary Market Research

- Data-driven Consulting and Strategic Advice

Our strategic management reports assist our clients in the assessment and management of future uncertainties. REnergyCO reports are a cost-effective way to receive fast, in-depth analysis of the market’s trends and their driving forces

Global Trends in Crude Oil and Gas Production

The global energy market continues to be shaped by geopolitical conflicts, policy shifts, and the long-term transition to cleaner energy. One of the most defining events of recent history was Russia’s full-scale invasion of Ukraine in 2022—an act of aggression that REnergyCO unequivocally condemns. We call for Putin to withdraw and restore the sovereign borders of neighboring countries.

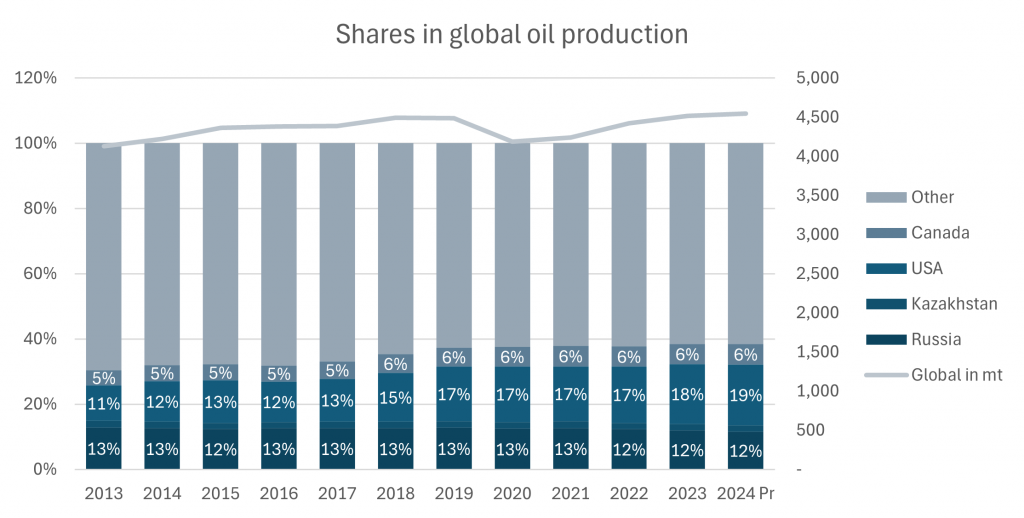

Despite sanctions—delayed and poorly enforced—Russia managed to maintain oil production but failed to expand it. Meanwhile, high oil prices primarily benefited producers in the U.S. and Canada. Looking ahead, the energy transition will progress despite natural setbacks, with oil and gas demand expected to stagnate and eventually decline.

Understanding these trends is essential for navigating the future of the industry.

OPEC+ prioritized price stability over production growth, adding further uncertainty to the future of the market.

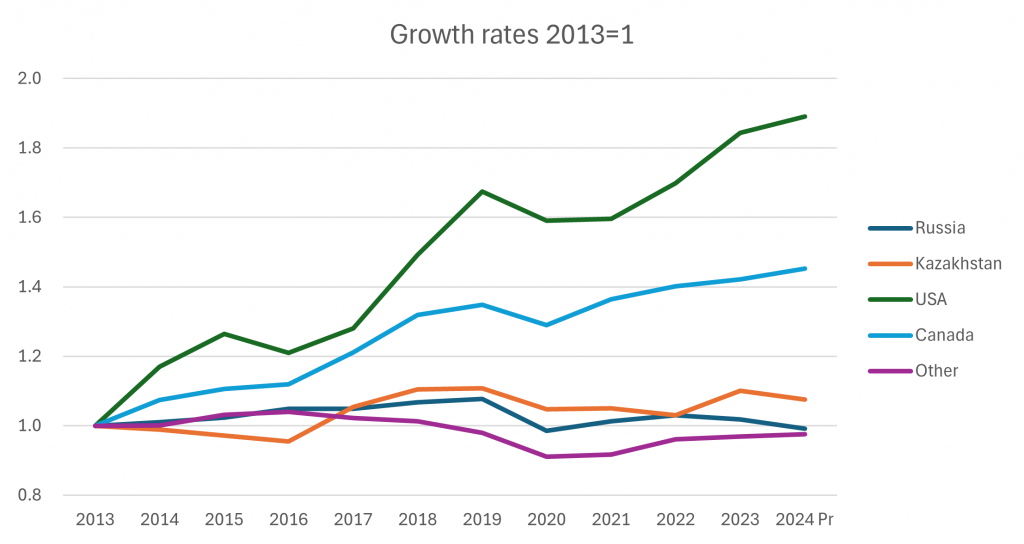

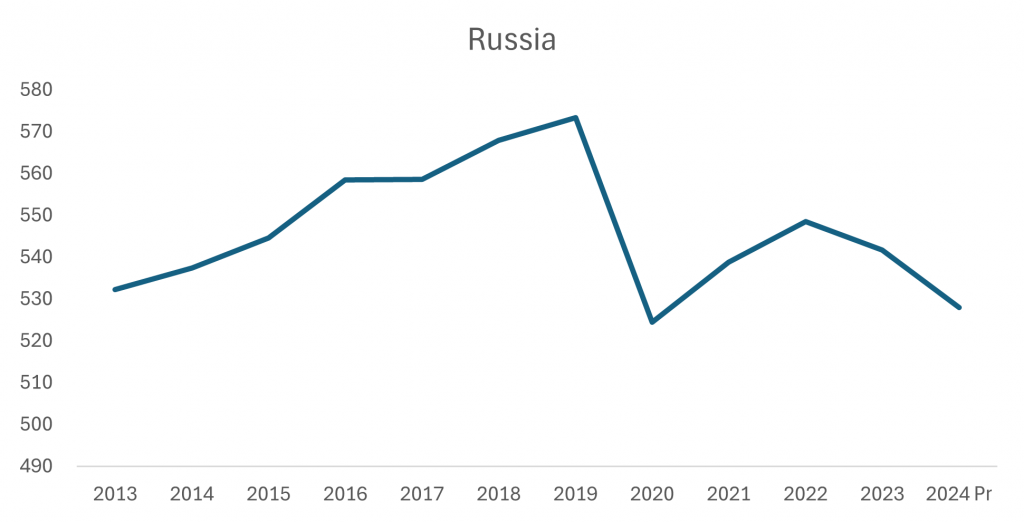

Russian oil production surged in 2019 but took a sharp hit in 2020 after a short-lived price war with Saudi Arabia and OPEC—a battle Moscow ultimately lost. While sanctions proved largely ineffective, price caps did manage to curb revenues to some extent. Minus 1% in 2024 to 2013.

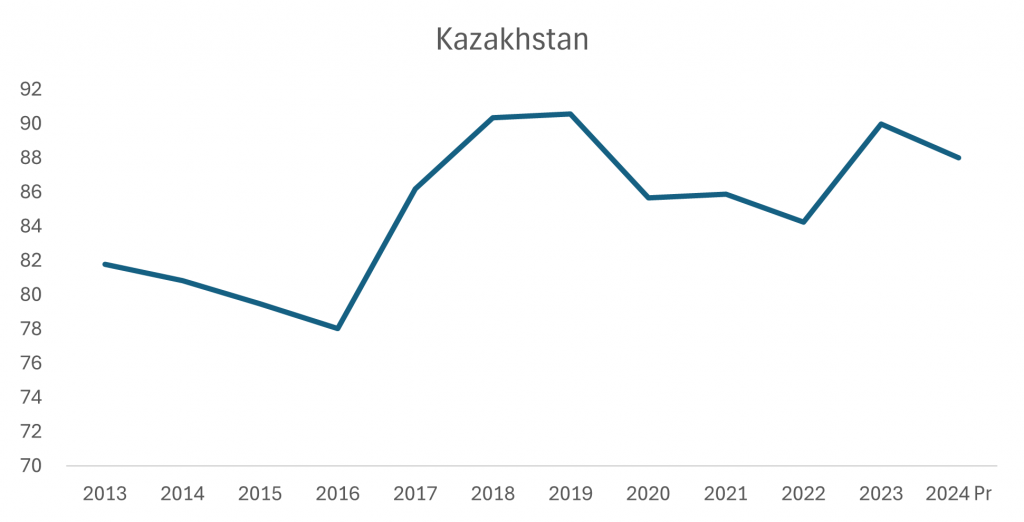

Kazakhstan’s oil production expanded following the long-delayed launch of the Kashagan field. However, growth remains constrained by its forced participation in OPEC+ and its reliance on Russia for crude oil transportation. Plus 7.5% in 2024 to 2013.

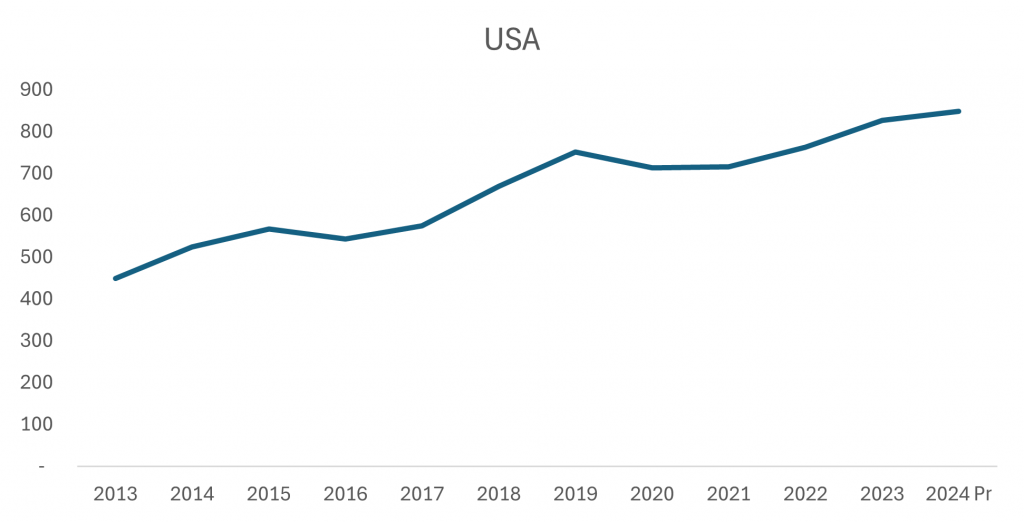

U.S. oil production in 2024 is up 89% compared to 2013—an increase of nearly 500 million tons, roughly matching the annual output of Russia or Saudi Arabia. In many ways, OPEC+ has worked to the advantage of the U.S.

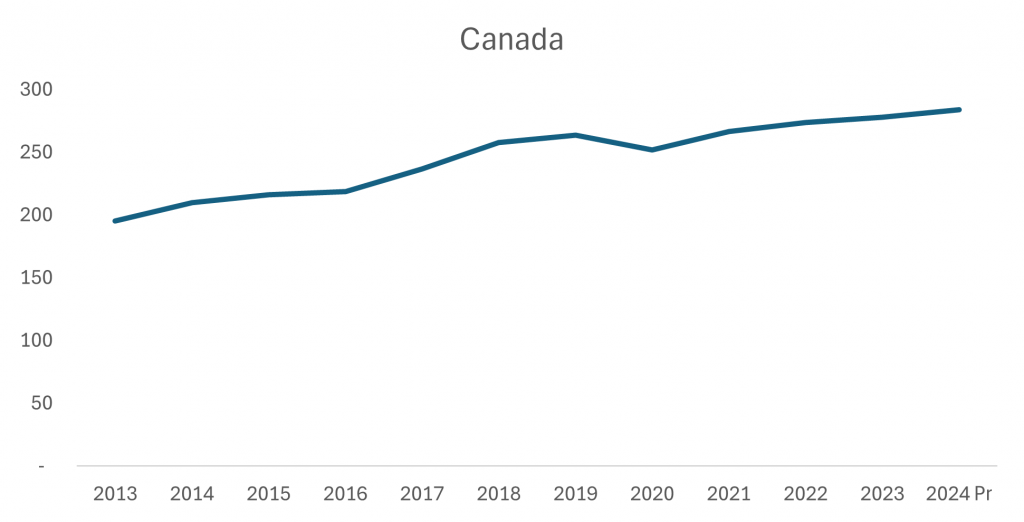

Canada’s oil production has grown by an amount equivalent to Kazakhstan’s total output, up 45% since 2013. Heavy investments made in the 2000s have made production largely indifferent to oil price fluctuations. Today, Canada is the primary supplier of heavy crude to the U.S. However, potential tariffs under the Trump administration could accelerate efforts to diversify export routes.